Cox Automotive UK has released its latest Car Market Tracker. Headline trends include used car market performance proving stronger than new cars performance and UK new car registrations suffering heavy losses compared to other European countries. Despite challenging market conditions there remains a subdued level of optimism.

Used car market

- Trade values easing as retailers become selective and hold back from increasing stock levels.

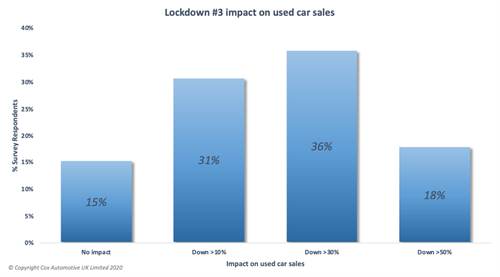

- The third lockdown caused a fall in used car sales. 67% of those surveyed indicated they are down 10 – 30% whilst 15% cited they had felt little or no impact.

- On an optimistic note, most of the used car sector operated more than 50% of usual seasonal performance and for many its business as usual.

According to Philip Nothard, Cox Automotive UK’s Customer Insight & Strategy Director “The sentiment from across the network is that there are ’pockets’ of weakness in retail which could be caused by increasing financial pressure - two-thirds of dealers reported an increase in both days in stock and overage vehicles. The advice given is to hold firm where possible.”

Nothard continues, “Many dealers acquired stock in Q4 of 2020 to be well placed for a fast start in 2021, although unfortunately some of this stock is now ageing. What’s clear is stocking the right car in terms of price point, model and good specification is key for the current trading conditions in 2021”.

New Car Performance

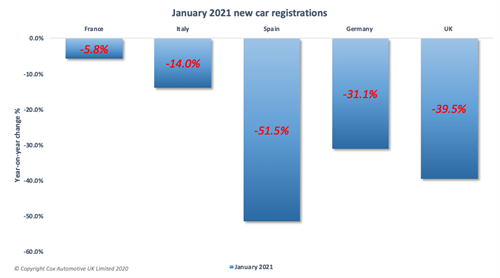

- New car registrations fell 39.5% to 90,249 as reported by the SMMT resulting in the worse observed since 1970.

- In the recent Cox Automotive Market Survey, 70% of dealers cited the third lockdown had caused between 10 – 30% reduction in new car orders, whilst 17% indicated it had hit them as badly as up to 50%.

- The survey did cite optimism, with over half (55%) dealers indicating they felt the economic conditions would improve over the coming months, with only 23% feeling it could worsen.

“In Europe, January new car registration results were mixed,” commented Nothard. “France (-5.8%) and Italy (-14%) performed relatively strongly compared to Germany at -31.5% followed by the UK at -39.5%. Spain felt the heaviest impact from the COVID pandemic at -51.1%. However, when looking at these figures, it’s important to remember that the outbreak in 2020 impacted at different times across Europe and each country responded at various levels.”

With regards to the wholesale market, Nothard notes that although there was a slow start to the year, the wholesale sector remains to see both strength and weakness as buyers continue to be selective.

“During January, wholesale activity saw an increase in the average mileage (64,496, +3.47% YoY) and age (89.5 months, +5.05% YoY). Despite this, average wholesale sold prices remain stable year-on-year at £6,134 (-2.01% YoY). In our recent Market Survey, over half (53%) felt it would remain the same in the first quarter, although a third (30%) cited a worsening."