Philip Nothard, insight & strategy director for Cox Automotive UK, shares his brief observations on the trends emerging in the car market this month.

Demand remains stable for now but expects it to ease into Q4

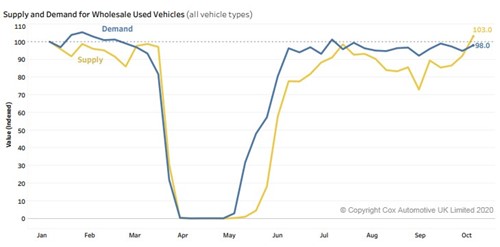

Since lockdown lifted back in June, demand for used vehicles has been relatively stable. However, as more localised lockdowns are introduced across the country, we could see reduced consumer confidence and demand easing in Q4.

Supply on the other hand - which has consistently tracked below demand since June reopening – has seen a steady increase throughout September and the first half of October, currently sitting at +3 index points ahead for the first time this year.

Wholesale prices add to dealer cash flow concerns

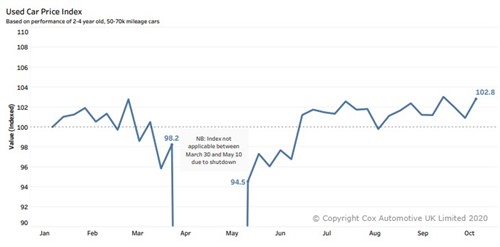

Cashflow concerns are growing across the automotive sector as the UK experiences localised lockdowns. Retailers are becoming increasingly cautious about their stocking levels and stock investment as we approach the end of the year, not helped by record auction prices.

With used car prices holding firm at +2.8 index points, these concerns are likely to continue for a while. However, as more supply enters the market, we expect to see some levelling in the market in Q4.

-4.4% new car registrations in September doesn’t tell the whole story

Although the headline figure of a -4.4% (-15,214) drop in registrations year-on-year isn’t as bad many predicted, it’s important to remember that this is still over 100k registrations behind a typical September registration month. 2020 has been the weakest year on record since the dual-plate introduction in 1999, illustrating the pressures on supply and the fleet and business sectors.

On a positive note, electric and hybrid vehicle registrations all performed well in September. Concerns remain though as to whether the accelerated EV ambitions by the Government are being sufficiently supported by incentive packages and infrastructure.